45 coupon vs zero coupon bonds

Zero Coupons and STRIPS - Federal Reserve Bank of New York Zero Coupons and STRIPS - FEDERAL RESERVE BANK of NEW YORK. Home > About the New York Fed >. Zero Coupons and STRIPS. This content is no longer available. Please see TreasuryDirect - STRIPS for current information on this subject. You will be automatically forwarded in 4 seconds, or click the link. By continuing to use our site, you agree to ... Zero Coupon Treasury Bonds (STRIPS) - Financial Web Zero Coupon Treasury Bonds (STRIPS) Zero coupon bonds are essentially the same product as all Treasury bonds, but they are paid out in a different manner. Essentially, instead of receiving the interest payments on the bond during the life of the bond, which is typical, the investor will receive the payment in full when the bond matures.

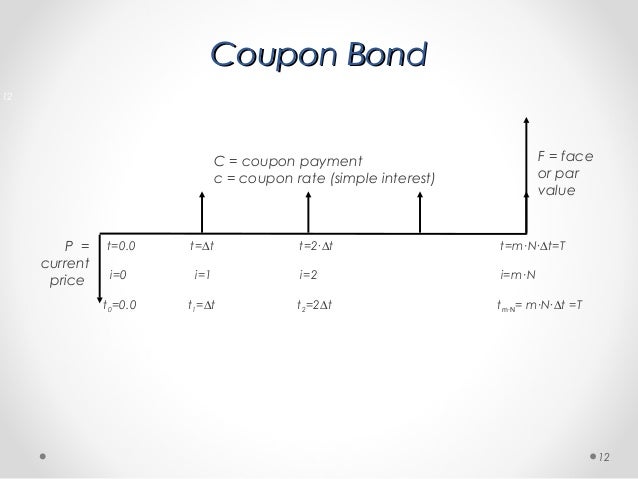

Bond Economics: Primer: Par And Zero Coupon Yield Curves Par and zero coupon curves are two common ways of specifying a yield curve. Par coupon yields are quite often encountered in economic analysis of bond yields, such as the Fed H.15 yield series. Zero coupon curves are a building block for interest rate pricers, but they are less commonly encountered away from such uses.

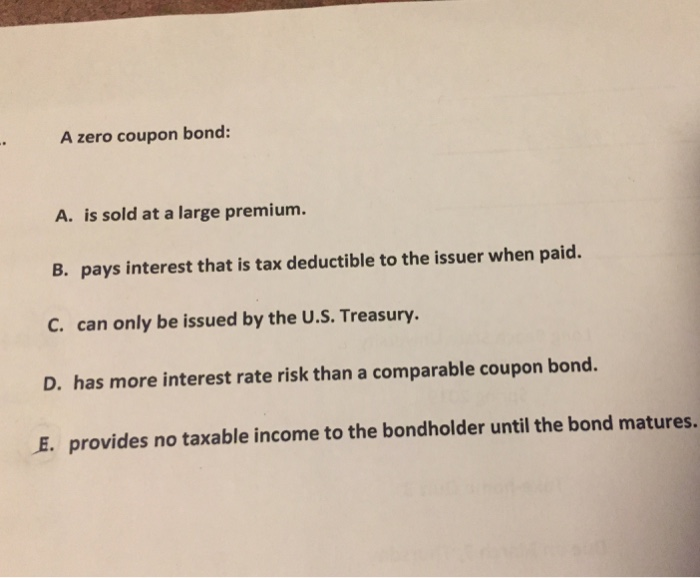

Coupon vs zero coupon bonds

What are Zero coupon bonds? - INSIGHTSIAS These are special types of zero coupon bonds issued by the government after proper due diligence and these are issued at par. What are these special type of zero coupon bonds? These are "non-interest bearing, non-transferable special GOI securities". They have a maturity of 10-15 years and issued specifically to Punjab & Sind Bank. What is the difference between a zero-coupon bond and a ... The difference between a regular bond and a zero-coupon bond is the payment of interest, otherwise known as coupons. A regular bond pays interest to bondholders, while a zero-coupon bond does not... Zero-Coupon Bond: Formula and Excel Calculator In contrast, for zero-coupon bonds, the difference between the face value and the bond's purchase price represents the bondholder's return. Due to the absence of coupon payments, zero-coupon bonds are purchased at steep discounts from their face value, as the next section will explain more in-depth. Zero-Coupon Bond - Bondholder Return

Coupon vs zero coupon bonds. What is the difference between a zero-coupon bond and a ... Answer (1 of 6): Biggest difference, the interest rate offered by the bond. A zero coupon bond yields no interest to the bondholder, while a regular bond pays its stated interest. On maturity however both payout their face values. So why would an investor buy a zero coupon bond? Simple, zero cou... deep discount bond vs zero coupon bond - OpenTuition 1)In general terms they do pay coupons.Generally the term applies to bonds issued at a discount on par (face) value of the bond in question. 2)No,they don't pay coupons. 3)Deep discounted bonds are issued at significant discount on par value.This means that often a significant amount of return comes from redemption and not coupon payments. Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww No reinvestment risk: Other coupon bonds don't allow investors to a bond's cash flow at the same rate as the investment's required rate of returns. But the Zero Coupon bonds remove the reinvestment risk. Zero Coupon bonds do not allow any periodic coupon payments and thus a fixed interest on Zero Coupon bonds is assured. Deep Discount Bond or Zero Coupon Bond - CommerceAngadi.com Some times, the company does not want to pay interest every month but to pay a lump sum at maturity. That time the company issue a bond at a deep discount, which is without any interest and also called as Zero-coupon bond. It is called a Deep Discount bond or Zero Coupon Bond.

The Zero Coupon Bond: Pricing and Charactertistics ... "Zero Coupon Bond" or "Strip Bond" are bonds that are created by "stripping" a normal bond into its constituent parts: the "Coupons" and "Residual" or "Resid". An investment dealer will first buy a bond and then "strip" it. The individual coupons are the semi-annual interest payments due on the bond prior to maturity. Zero Coupon Bond - Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. Coupon Bearing Bonds vs. Zero Coupon Bonds Dan is considering whether to issue coupon bearing bonds or zero coupon bonds. The YTM on either bond issue will be 7.5%. The coupon bond would have a 6.5% percent coupon rate. The company's tax rate is 35%. These are 20 year. About Discount Bonds versus Zero Coupon Bonds - Accounting ... Zero Coupon bonds generally have a Maturity Date that is more than a year and a half out from the issue date. Unlike discount bonds, Zero Coupons do take compounding into account, and are generally issued with a semi-annual compounding yield; therefore, they have a Payment Frequency equal to the standard payment frequency of semi-annual.

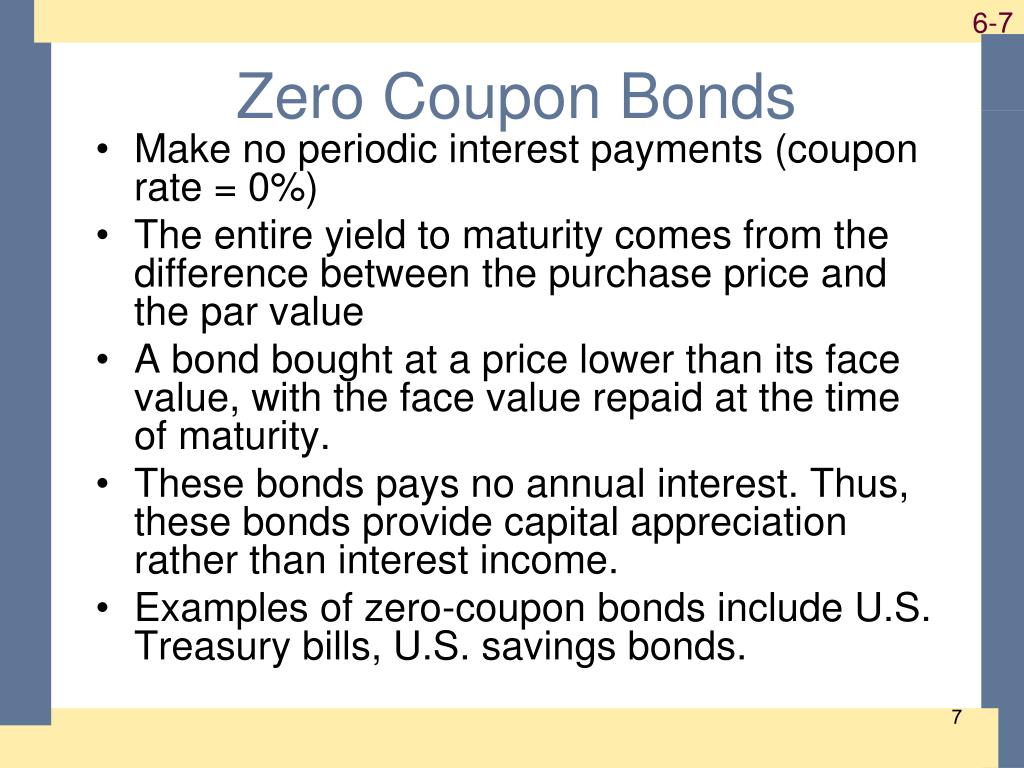

Zero Coupon Municipal Bonds: Tax Treatment - TheStreet For example, a 10-year zero-coupon bond sold at a price of 50 (or $500 for a $1,000 bond) offers an interest rate, or yield, of 7.05%. As explained to me by Michael Decker of the Bond Market ... Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. Should I Invest in Zero Coupon Bonds? | The Motley Fool So for instance, a 10-year zero coupon bond priced when prevailing yields were 3% would typically get auctioned for roughly $750 per $1,000 in face value. The $250 difference would essentially... Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value.

Special Zero Coupon Recapitalisation Bonds The Zero Coupon bonds generally come with a time horizon of 10 to 15 years. Difference: Special Zero Coupon Bonds are being issued at par, there is no interest however Normal Zero Coupon Bonds are issued at discount therefore they technically are interest bearing. Bonds

Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and...

Zero Coupon Bond - WallStreetMojo Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

Zero Vs Fixed Coupon Bond volatility | QuantNet Community Everywhere I look for this on the internet I read that Zero Coupon Bonds are more volatile than Fixed Coupon Bonds. The explanation for this seems to be that the Duration (both Macaulay and Modified) are larger the lower the size of the coupon is, and consequently a, let's say 10Y ZC Bond has a larger duration than a 10Y 5% Coupon Bond.

What Is the Coupon Rate of a Bond? Another type of bond is a zero coupon bond, which does not pay interest during the time the bond is outstanding. Rather, zero coupon bonds are sold at a discount to their value at maturity. Maturity dates on zero coupon bonds tend to be long term, often not maturing for 10, 15, or more years.

Zero Coupon Bond Calculator - What is the Market Price ... Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000. Interest Rate: 10%. Time to Maturity: 10 Years, 0 Months. Substituting into the formula: P ( 1 + r) t = 1 0 0 0 ( 1 +.

What is a Zero Coupon Bond? Who Should Invest? | Scripbox A coupon is an interest the bond issuer pays the bondholder. Coupon payments happen periodically from the time of issuance of the bond until its maturity. A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond.

5. A zero-coupon bond with face value $1,000 and maturity ... A zero-coupon bond with face value $1,000 and maturity of five years sells for $746.22. What is its yield to maturity? What will happen to its yield to maturity if its price falls immediately to $730? 9. A bond with an annual coupon rate of 4.8% sells for $970. What is the bond's current yield?

Understanding Zero Coupon Bonds - Part One Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value Some issuers may call zeros before maturity You must pay tax on interest annually even though you don't receive it until maturity Zero coupon bonds are more volatile than regular bonds

What Is a Zero Coupon Yield Curve? (with picture) A zero coupon bond does not pay interest but instead carries a discount to its face value. The investor therefore receives one payment of the face value of the bond on its maturity. This face value is the equivalent of the principal invested plus interest over the life of the bond.

Zero-Coupon Bond: Formula and Excel Calculator In contrast, for zero-coupon bonds, the difference between the face value and the bond's purchase price represents the bondholder's return. Due to the absence of coupon payments, zero-coupon bonds are purchased at steep discounts from their face value, as the next section will explain more in-depth. Zero-Coupon Bond - Bondholder Return

What is the difference between a zero-coupon bond and a ... The difference between a regular bond and a zero-coupon bond is the payment of interest, otherwise known as coupons. A regular bond pays interest to bondholders, while a zero-coupon bond does not...

What are Zero coupon bonds? - INSIGHTSIAS These are special types of zero coupon bonds issued by the government after proper due diligence and these are issued at par. What are these special type of zero coupon bonds? These are "non-interest bearing, non-transferable special GOI securities". They have a maturity of 10-15 years and issued specifically to Punjab & Sind Bank.

:max_bytes(150000):strip_icc()/TheWayYouTitleYourUnitedStatesSavingsBondsCanHaveTaxConsequences-56ae67705f9b58b7d010097f.jpg)

Post a Comment for "45 coupon vs zero coupon bonds"