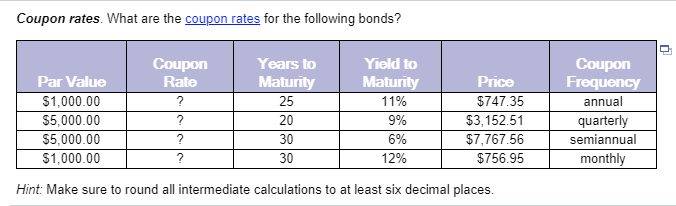

42 formula for coupon rate

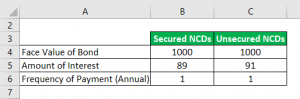

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate Finally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by 100%, as shown below. Examples. Let us take the example of a bond with quarterly coupon payments. Let us assume a company XYZ Ltd has issued a bond having a face value of $1,000 and ... › capacity-utilization-rate-formulaCapacity Utilization Rate Formula | Calculator (Excel template) Capacity Utilization Rate Formula in Excel (With Excel Template) Here we will do the same example of the Capacity Utilization Rate formula in Excel. It is very easy and simple. You need to provide the two inputs actual output and Maximum possible output. You can easily calculate the Capacity Utilization Rate using Formula in the template provided.

How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

Formula for coupon rate

Common Stock Formula | Calculator (Examples with Excel … Common Stock = $1,000,000 – $300,000 – $200,000 – $100,000 + $100,000; Common Stock = $500,000 Therefore, FGH Ltd’s common stock stood at $500,000 as on December 31, 2018. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The coupon payment is denoted by C, and it is calculated as C = Coupon rate * P / Frequency of coupon payment Next, determine the total number of periods till maturity by multiplying the frequency of the coupon payments during a year and the number of years till maturity. Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year.

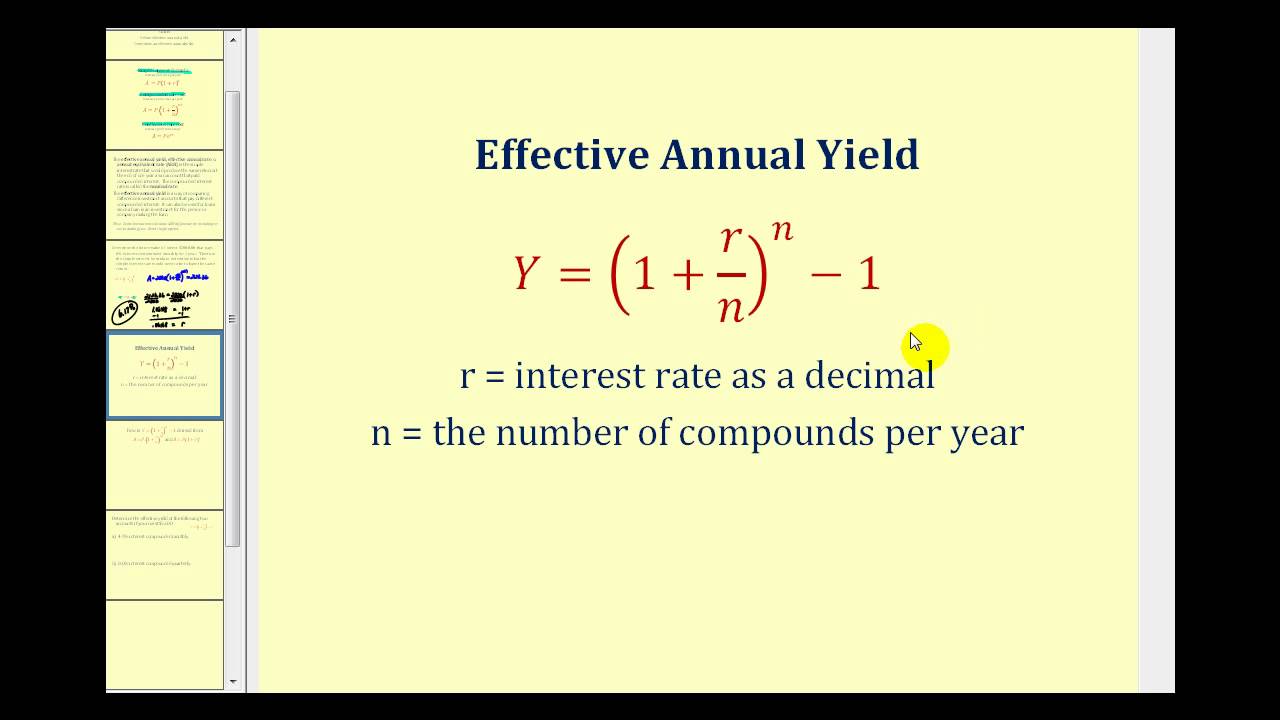

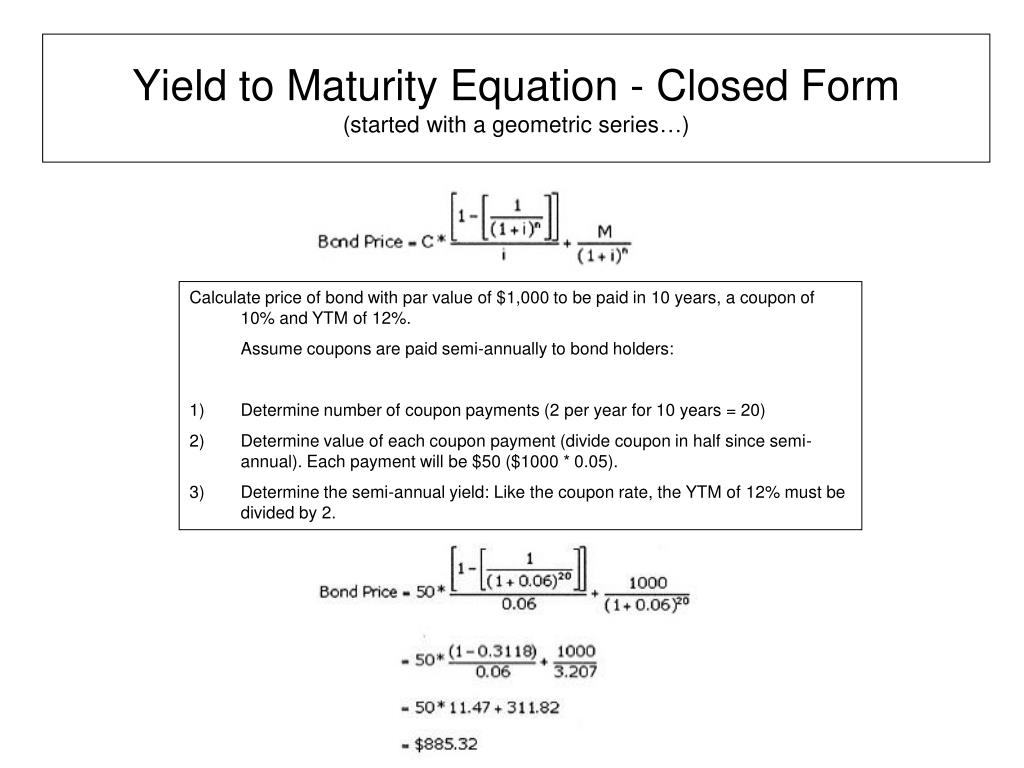

Formula for coupon rate. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, ... Coupon Bond Formula | Examples with Excel Template Mathematically, the formula for coupon bond is represented as, Coupon Bond = ∑ [ (C/n) / (1+Y/n)i] + [ F/ (1+Y/n)n*t] or Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] where, C = Annual Coupon Payment, F = Par Value at Maturity, Y = Yield to Maturity, n = Number of Payments Per Year t = Number of Years Until Maturity Capacity Utilization Rate Formula | Calculator (Excel template) Capacity Utilization Rate Formula in Excel (With Excel Template) Here we will do the same example of the Capacity Utilization Rate formula in Excel. It is very easy and simple. You need to provide the two inputs actual output and Maximum possible output. You can easily calculate the Capacity Utilization Rate using Formula in the template provided. What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ...

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon paymentby the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rateis $50 / $1,000 = 5%. Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator This calculator calculates the coupon rate using face value, coupon payment values. Coupon Rate Calculation. ... Submit Reset. Coupon Rate % Formula: Coupon Rate = (Coupon Payment × No of Payment) / Face Value . Related Calculators Acid Test Ratio Business Financial Insolvency Ratio Cap Rate Capital Gains Yield Capitalization Rate Cash To ... Coupon Rate: Definition, Formula & Calculation - Study.com Coupon Rate Formula. The formula for coupon rate is as follows: C = i / p. where: C = coupon rate. i = annualized interest (or coupon) p = par value of bond. › coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) - EDUCBA Relevance and Uses of Coupon Rate Formula. Coupon Rate Formula helps in calculating and comparing the coupon rate of differently fixed income securities and helps to choose the best as per the requirement of an investor. It also helps in assessing the cycle of interest rate and expected market value of a bond, for eg.

Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Excel Formula to Calculate Commissions with Tiered Rate Structure May 15, 2013 · In the image below the Payout Rate for the 0%-40% range is 0.50. This means that for every 1% attained, the payout will be 0.50 of the 20% total payout. Payout Rate =([tier attainment max] – [tier attainment min]) / ([payout % this tier] – [payout % previous tier]) Rate Curve. The payout rate is also known as the rate curve. The rate curve ... How To Calculate Compound Interest In Excel: Formula + Template Compound interest is when you’re able to reinvest the interest, instead of paying it out.. It’s better understood in comparison with the concept of simple interest.. For example, you deposited $1,000 on a bank at 3% for a year. After a year, your money will grow from $1,000 to $1,030.Your initial deposit earned $30 as interest.. Now, let’s say you deposited the same amount of money … › modeling › calculateExcel Formula to Calculate Commissions with Tiered Rate ... May 15, 2013 · In the image below the Payout Rate for the 0%-40% range is 0.50. This means that for every 1% attained, the payout will be 0.50 of the 20% total payout. Payout Rate =([tier attainment max] – [tier attainment min]) / ([payout % this tier] – [payout % previous tier]) Rate Curve. The payout rate is also known as the rate curve. The rate curve ...

Calculate the Coupon Rate of a Bond - YouTube This video explains how to calculate the coupon rate of a bond when you are given all of the other terms (price, maturity, par value, and YTM) with the bond ...

What Is the Coupon Rate of a Bond? - The Balance The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

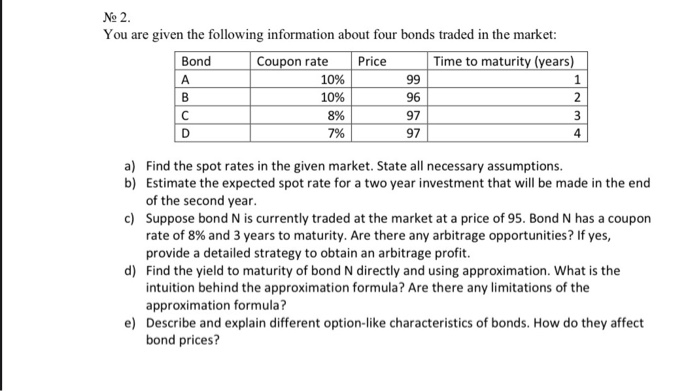

Bond Yield Formula | Step by Step Calculation & Examples Suppose a bond has a face value of $1300. And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate = 6%; Bond Price = $1600; Solution: Here we have to understand that this calculation completely depends on annual coupon and bond price.

Coupon Definition - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Simple Interest Rate Formula | Calculator (Excel template) Simple Interest Rate Formula – Example #3. DHFL Ltd issued a coupon-bearing bond of Rs.100000 which carries an interest rate of 7% p.a. the bond has a useful life of 15 months, after which the bond will be redeemed. Interest earned by the investor can be calculated as follows:

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's yield, or coupon rate, is computed by dividing its coupon payment by its face value. An updated yield rate can be computed by dividing its coupon by the current market price of the bond....

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... Formula The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond All types of bonds pay interest to the bondholder.

Coupon Payment | Definition, Formula, Calculator & Example The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2]. This means that Walmart Stores Inc. pays $32.5 after each six months to bondholders. Please note that coupon payments are calculated based on the stated interest rate (also called nominal yield) rather than the yield to maturity or the current yield.

› coupon-rate-formulaCoupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link

› discount-rate-formulaDiscount Rate Formula | How to calculate Discount Rate with ... Discount Rate = ($3,000 / $2,200) 1/5 – 1 Discount Rate = 6.40% Therefore, in this case the discount rate used for present value computation is 6.40%. Discount Rate Formula – Example #2

Bond Pricing Formula | How to Calculate Bond Price? | Examples Given, F = $100,000. C = 7% * $100,000 = $7,000. n = 15. r = 9%. The price of the bond calculation using the above formula as, Bond price = $83,878.62. Since the coupon rate. Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate Formula. Coupon Rate is the interest rate that is paid on a bond/fixed income security. It is stated as a percentage of the face value of the bond when the bond is issued and continues to be the same until it reaches maturity. Once fixed at the issue date, coupon rate of bond remain unchanged till the tenure of the bond and the ...

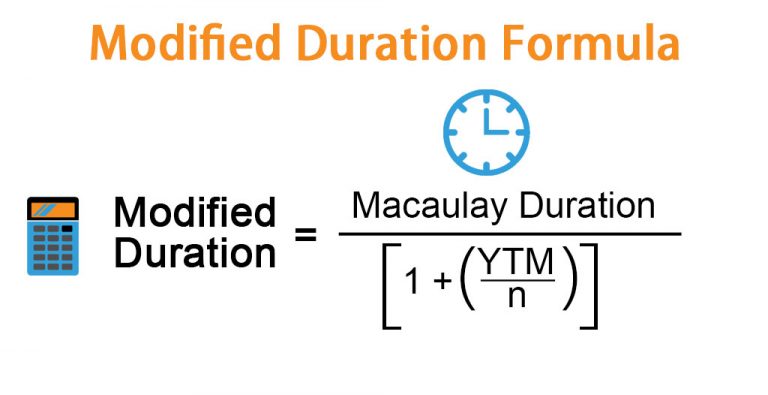

Coupon Bond - Guide, Examples, How Coupon Bonds Work The formula is: Where: c = Coupon rate. i = Interest rate. n = number of payments. Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the payments on this type of bond are fixed and set over fixed time periods: More Resources

Coupon Equivalent Rate (CER) Definition - Investopedia The coupon equivalent rate (CER) is calculated as: Find the discount the bond is trading at, which is face value less market value. Then divide the discount by the market price. Divide 360 by the...

Future Value Formula And Calculator Mar 04, 2020 · The future value formula helps you calculate the future value of an investment (FV) for a series of regular deposits at a set interest rate (r) for a number of years (t). Using the formula requires that the regular payments are of the same amount each time, with the resulting value incorporating interest compounded over the term.

Coupon Rate Template - Free Excel Template Download The formula for calculating the coupon rate is as follows: Where: C = Coupon rate. I = Annualized interest. P = Par value, or principal amount, of the bond. More Free Templates. For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentation, and Word document templates.

Post a Comment for "42 formula for coupon rate"