42 what is the duration of a zero coupon bond

Zero-Coupon Bond Definition - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving... Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a …

What Is a Zero-Coupon Bond? - The Motley Fool Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 = $6,139.11 This means that given the above variables, you'd be able to purchase a bond for $6,139.11, wait 10 years, and redeem it for $10,000....

What is the duration of a zero coupon bond

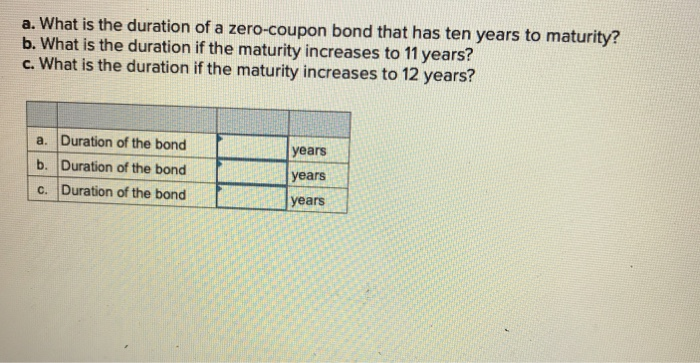

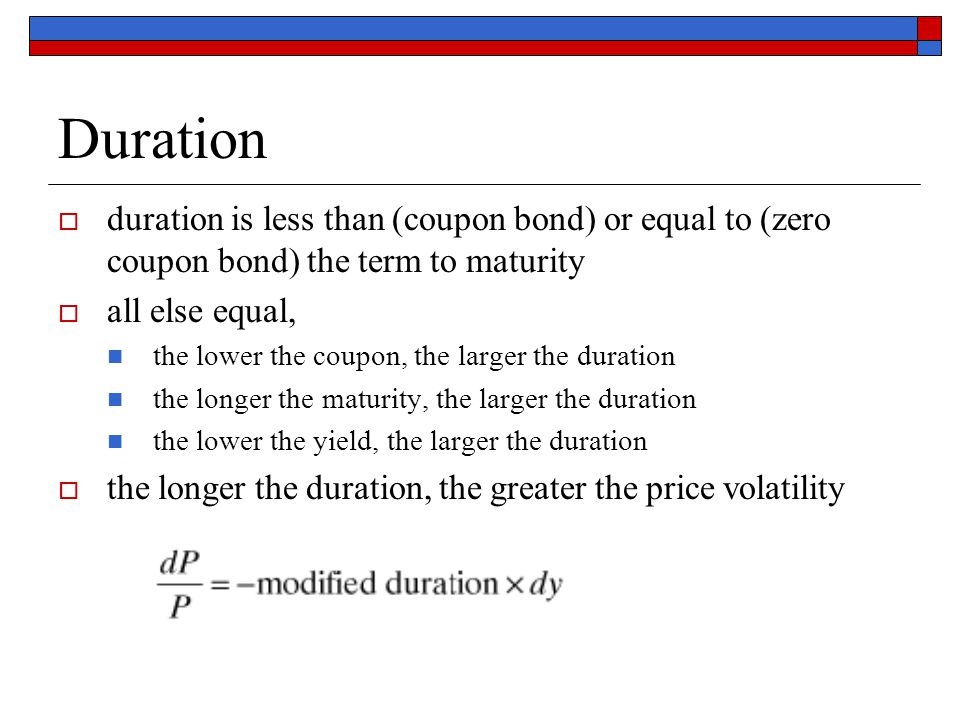

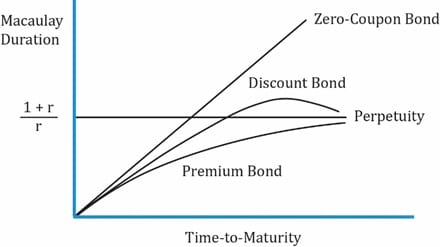

Duration: Understanding the Relationship Between Bond … Duration is expressed in terms of years, but it is not the same thing as a bond's maturity date. That said, the maturity date of a bond is one of the key components in figuring duration, as is the bond's coupon rate. In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. When a coupon is ... Zero Coupon Bond | Definition, Formula & Examples - Study.com A zero-coupon bond still has 5 years to mature and is currently priced at $760 in the capital market. Assume that the face value is $1,000 and the required interest rate of the bond is 5%... What is zero coupon bonds? - myITreturn Help Center Long-term zero coupon maturity dates typically start at ten to fifteen years. The bonds can be held until maturity or sold on secondary bond markets. Short-term zero coupon bonds generally have maturities of less than one year and are called bills. The U.S. treasury bill market is the most active and liquid debt market in the world.

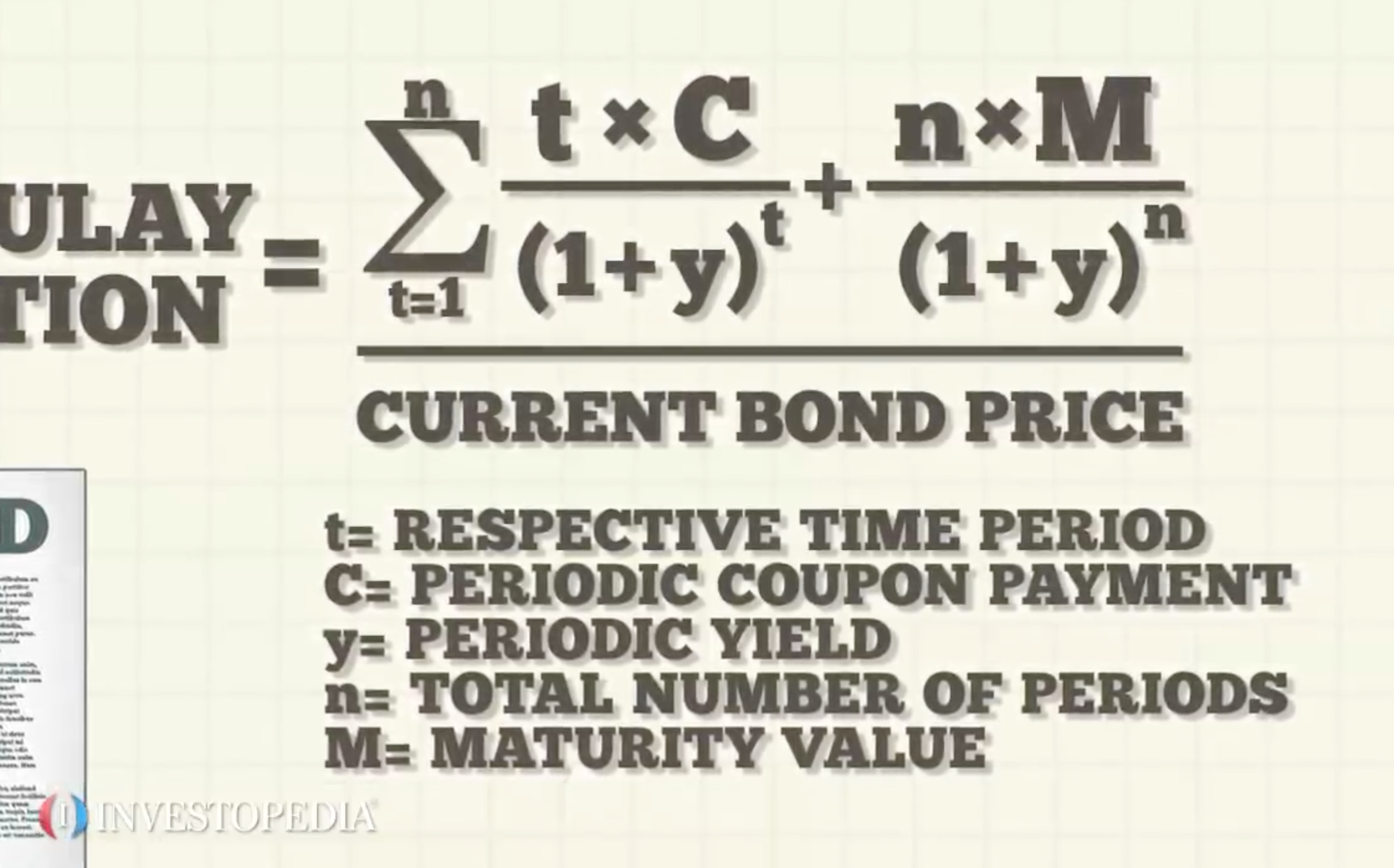

What is the duration of a zero coupon bond. What Is a Zero-Coupon Bond? Definition, Advantages, Risks Essentially, when you buy a zero, you're getting the sum total of all the interest payments upfront, rolled into that initial discounted price. For example, a zero-coupon bond with a face value of... Calculate Price, Yield to Maturity & Imputed Interest for a Zero Coupon ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Duration of a Bond | Portfolio Duration | Macaulay & Modified Duration 11/06/2022 · Bond Duration Vs. Bond Maturity. The maturity of the bond states the period by which the last cash flow arising from the bond will be received. Duration of a bond, on the other hand, is a slightly technical and advanced spin on bond maturity. It is a weighted average period of time until all the cash flows from the bond are received. Weights ...

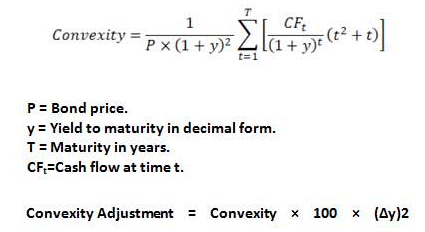

Convexity of a Bond | Formula | Duration | Calculation while the duration of the zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay periodic interest. In other words, the annual implied interest payment is included into the face value of the bond, … Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1 Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value What Is the Coupon Rate of a Bond? - The Balance Maturity dates on zero coupon bonds tend to be long term, often not maturing for 10, 15, or more years. 1 Though zero coupon bonds do not pay any interest, by looking at what you paid for it, the maturity value, and the duration of the bond, you can reverse engineer the equivalent of an annual interest rate. ZROZ ETF Report: Ratings, Analysis, Quotes, Holdings | ETF.com Learn everything about PIMCO 25+ Year Zero Coupon US Treasury Index ETF (ZROZ). Free ratings, analyses, holdings, benchmarks, quotes, and news.

Zero-Coupon CDs: What They Are And How They Work | Bankrate How zero-coupon CDs work. You pay a discounted price for a zero-coupon CD in exchange for not being paid interest throughout the term. You receive the full face value of the CD once it matures ... Macaulay Duration - Overview, How To Calculate, Factors A zero-coupon bond assumes the highest Macaulay duration compared with coupon bonds, assuming other features are the same. It is equal to the maturity for a zero-coupon bond and is less than the maturity for coupon bonds. Macaulay duration also demonstrates an inverse relationship with yield to maturity. Zero Coupon Bond Calculator - Calculator Academy Zero Coupon Bond Formula. The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t. where ZCBV is the zero-coupon bond value. F is the face value of the bond. r is the yield/rate. t is the time to maturity. What Is Duration of a Bond? - TheStreet Definition - TheStreet The easiest duration to calculate is that of a zero-coupon bond. This bond has zero yield, which means it does not pay any interest. Its duration is equal to its time to maturity. When a coupon is...

What Is a Zero Coupon Yield Curve? (with picture) - Smart Capital Mind The zero coupon rate is the return, or yield, on a bond corresponding to a single cash payment at a particular time in the future. This would represent the return on an investment in a zero coupon bond with a particular time to maturity.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Enter the face value of a zero-coupon bond, the stated annual percentage rate (APR) on the bond and its term in years (or months) and we will return both the upfront purchase price of the bond, its nominal return over its duration & its yield to maturity. Entering Years: For longer duration bonds enter the number of years to maturity. Entering Months: For shorter duration …

South Africa Government Bonds - Yields Curve The South Africa 10Y Government Bond has a 10.555% yield.. 10 Years vs 2 Years bond spread is 358.5 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 6.25% (last modification in September 2022).. The South Africa credit rating is BB-, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 313.76 and implied probability of default ...

Zero Coupon Bonds: Know tax rules when such a bond is held till ... Further, as per the provisions of section 2 (42A) of the IT Act, if a zero coupon bond is held for a period up to 12 months then the same will be treated as short term capital asset and the gains...

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund ... 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund. Share. ... Holdings are subject to change at any time. The Fund uses an indexing approach and may be affected by a general decline in market segments or asset classes relating to its Underlying Index. ... (YTM) is the estimated total return of a bond if held to maturity. YTM ...

Advantages and Risks of Zero Coupon Treasury Bonds 31/01/2022 · If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset It is based on the face value of the bond at the time of issue, otherwise known as the bond's "par value" or principal. Though the coupon rate on bonds and other securities can pay off for investors, you have to know how to calculate and evaluate this important number. ... For example, ABC Corp. could issue a 10-year, zero-coupon bond ...

BONDS Practice Questions_14 Sep 2022.pdf - FIXED INCOME... A zero coupon bond with a face value of $300 is selling at $189.05 today. Calculate the yield to maturity if the bond matures in 5 years. 6. A bond maturing in 10 years has a face value of $1,000 and pays semi annual coupon payments at a coupon rate of 6%. If YTM is 8%, how much is the bond worth today (immediately after the coupon is paid)?

How to Calculate the Bond Duration (example included) PV = Bond price = 963.7 FV = Bond face value = 1000 C = Coupon rate = 6% or 0.06 Additionally, since the bond matures in 2 years, then for semiannual bond you'll have a total of 4 coupon payments (one payment every 6 months), such that: t1 = 0.5 years t2 = 1 years t3 = 1.5 years t4 = tn = 2 years

The Macaulay Duration of a Zero-Coupon Bond in Excel - Investopedia Calculating the Macauley Duration in Excel Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In columns A and...

Duration: Definition, Calculation & Types | Seeking Alpha Since there are no coupon payments, the duration of zero-coupon bonds is equal to their time to maturity. ... The lower a bond's coupon rate, the longer the bond's duration will be because less ...

United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 3.329% yield. 10 Years vs 2 Years bond spread is -12.7 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in August 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency. Current 5-Years Credit Default Swap ...

What Is Duration in Finance? - Investopedia 01/09/2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ...

Zero coupon, zero principal bond declared securities The Finance Ministry has declared zero coupon zero principal instruments (ZCZP) as securities. Experts say this will help many organisations including corporates to utilise their fund marked for ...

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity ...

What is a Zero-Coupon Bond? - Realonomics The Zero Coupon bonds eliminate the reinvestment risk. Zero-Coupon bonds do not let any periodic coupon payments, and hence a fixed interest on Zero Coupon bonds is guaranteed. Fixed returns: The Zero Coupon bond is a perfect choice for those who prefer long-term investment and earn a lump sum.

MC Explains | What is a 'zero-coupon, zero-principal' instrument? "These bonds will carry a tenure equal to the duration of a given project," said Nitin Iyer, AVP Products at IIFL. It has been proposed that the issue size will need to be a minimum of Rs 1 crore...

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

Duration of a Bond | Portfolio Duration | Macaulay & Modified Duration Duration of a bond measures the movement in the price of the bond for every 1% change in the interest rate. ... to be received. As the bond approaches maturity, the gap between the duration and maturity reduces but never becomes zero. Where, ... Bond: Coupon Rate: Maturity: Market Price ($) Units Held: Market Value ($) Weights: A: 10%: 5 years ...

What is zero coupon bonds? - myITreturn Help Center Long-term zero coupon maturity dates typically start at ten to fifteen years. The bonds can be held until maturity or sold on secondary bond markets. Short-term zero coupon bonds generally have maturities of less than one year and are called bills. The U.S. treasury bill market is the most active and liquid debt market in the world.

Zero Coupon Bond | Definition, Formula & Examples - Study.com A zero-coupon bond still has 5 years to mature and is currently priced at $760 in the capital market. Assume that the face value is $1,000 and the required interest rate of the bond is 5%...

Duration: Understanding the Relationship Between Bond … Duration is expressed in terms of years, but it is not the same thing as a bond's maturity date. That said, the maturity date of a bond is one of the key components in figuring duration, as is the bond's coupon rate. In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. When a coupon is ...

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/13-Figure5-1.png)

Post a Comment for "42 what is the duration of a zero coupon bond"