39 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest

Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Assignment Essays - Best Custom Writing Services The more pages you order, the less you pay. We can also offer you a custom pricing if you feel that our pricing doesn't really feel meet your needs. Proceed To Order. Writing. Fine-crafting custom academic essays for each individual’s success - on time. Editing.

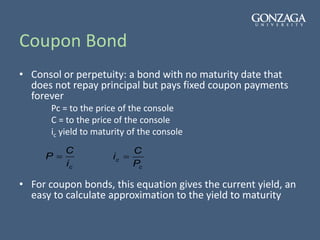

Fixed Income Glossary - Common Fixed Income Terms - Fidelity coupon coupon: the interest rate a bond's issuer promises to pay to the bondholder until maturity, or other redemption event, generally expressed as an annual percentage of the bond's face value; for example, a bond with a 10% coupon will pay $100 per $1000 of the bond's face value per year, subject to credit risk; when searching Fidelity's ...

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest

Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Glossary - Common Fidelity Terms - Fidelity coupon coupon: the interest rate a bond's issuer promises to pay to the bondholder until maturity, or other redemption event, generally expressed as an annual percentage of the bond's face value; for example, a bond with a 10% coupon will pay $100 per $1000 of the bond's face value per year, subject to credit risk; when searching Fidelity's ... Interest - Wikipedia In finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct from a fee which the borrower may pay the lender or some third party. It is also distinct from dividend which is paid by a company to its …

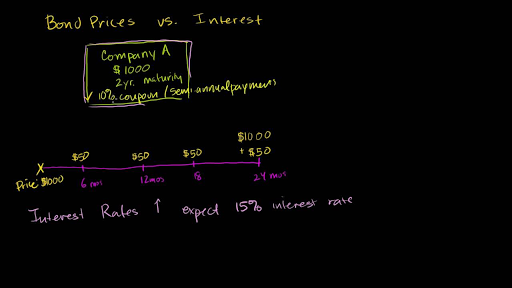

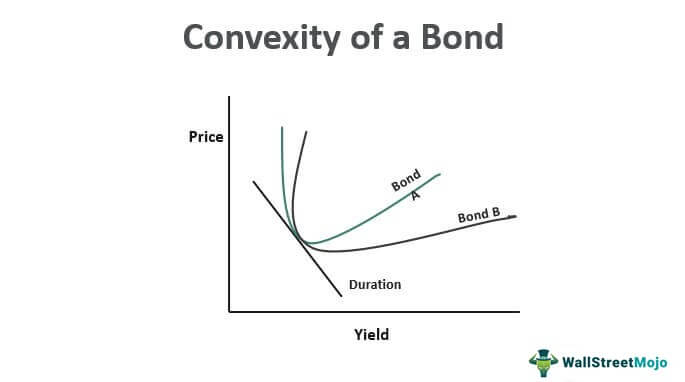

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest. Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond that issues 3% coupon payments may now be "outdated" if interest rates have increased to 5%. To compensate for this, the bond will be sold at a discount in secondary market. When is a bond's coupon rate and yield to maturity the same? - Investopedia Jan 13, 2022 · For example, if a company issues a $1,000 bond with a 4% interest rate, but the government subsequently raises the minimum interest rate to 5%, then any new bonds being issued have higher coupon ... Mortgage-backed security - Wikipedia A mortgage-backed security (MBS) is a type of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment bank) that securitizes, or packages, the loans together into a security that investors can buy.Bonds securitizing mortgages are usually … Bond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

Interest - Wikipedia In finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct from a fee which the borrower may pay the lender or some third party. It is also distinct from dividend which is paid by a company to its … Glossary - Common Fidelity Terms - Fidelity coupon coupon: the interest rate a bond's issuer promises to pay to the bondholder until maturity, or other redemption event, generally expressed as an annual percentage of the bond's face value; for example, a bond with a 10% coupon will pay $100 per $1000 of the bond's face value per year, subject to credit risk; when searching Fidelity's ... Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods.

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

![[OC] I compressed 30 years of US interest rate history in one minute and 22 seconds for someone at the IMF](https://external-preview.redd.it/dJmqhCjG6AQ2EwwGej3oM9ZL_N4ux_iGxHch6shncrs.png?format=pjpg&auto=webp&s=6bf6fd47fe79b4507e6beb251e424d05d6c22ec7)

Post a Comment for "39 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest"