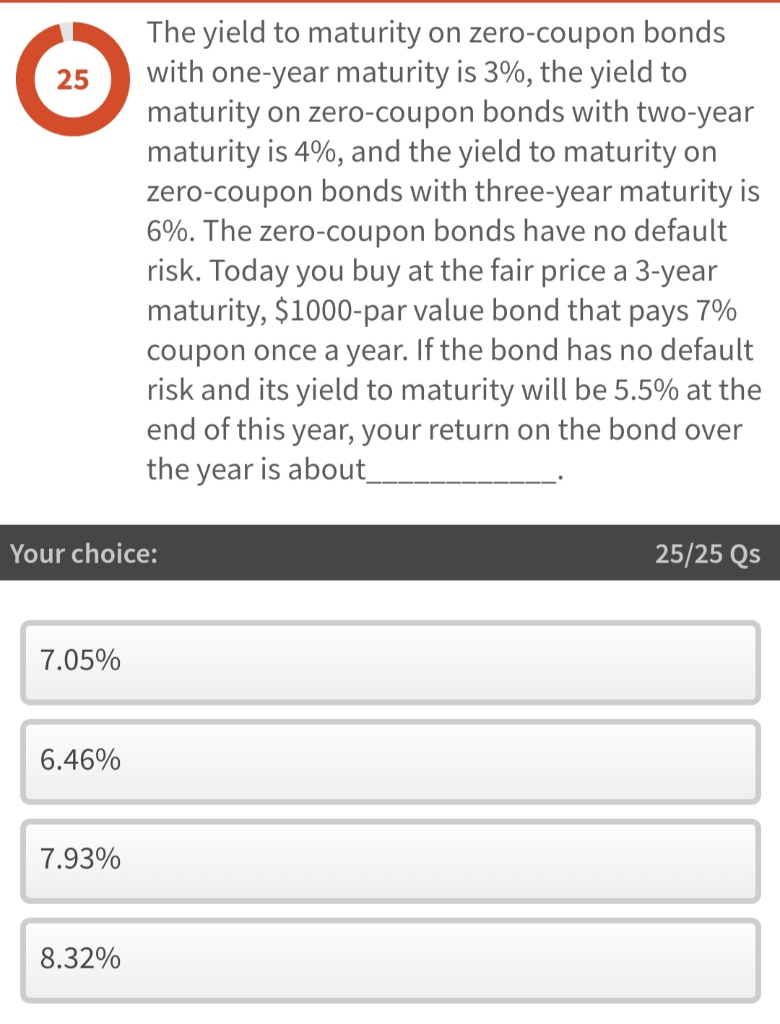

42 yield to maturity for zero coupon bond

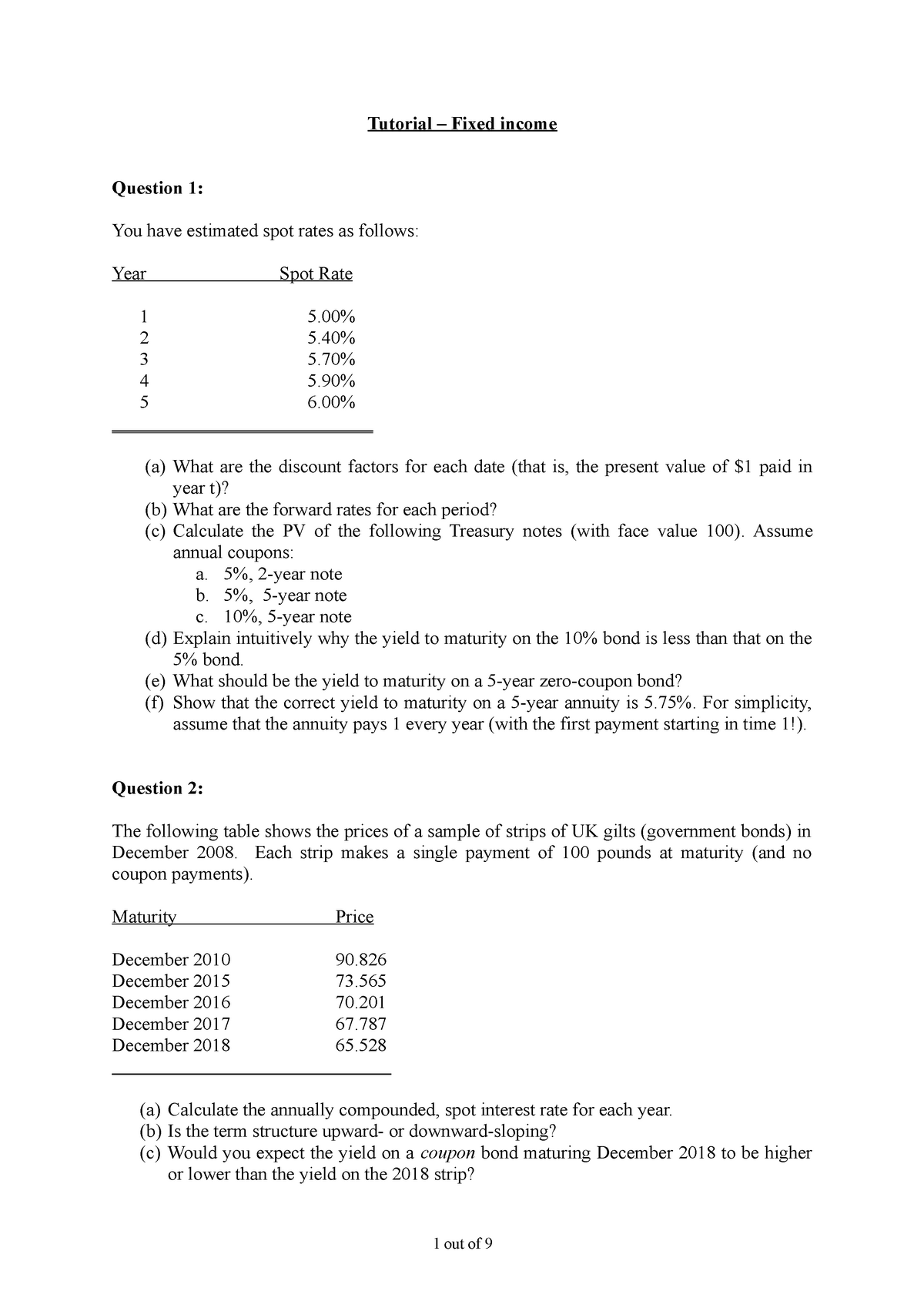

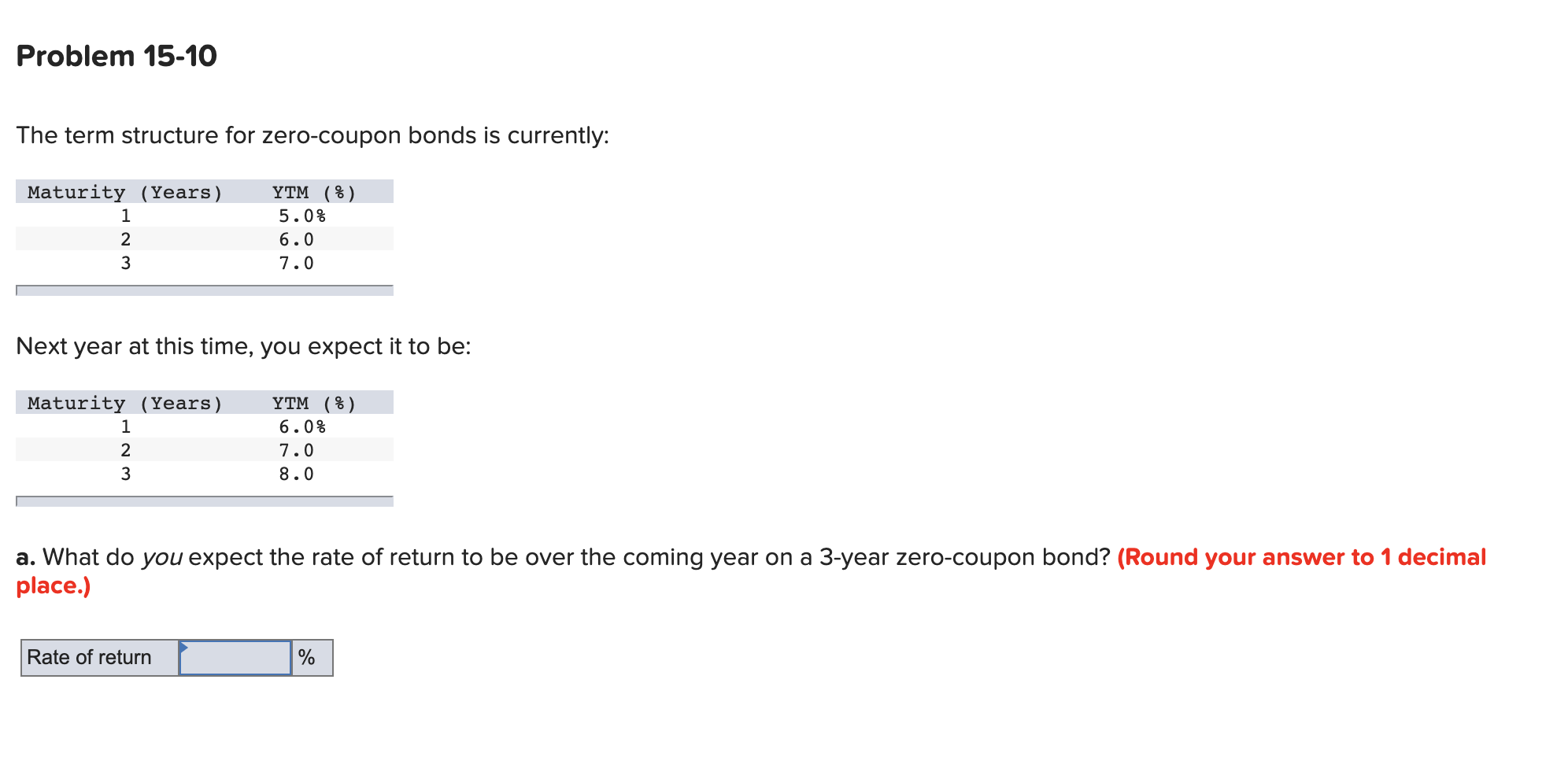

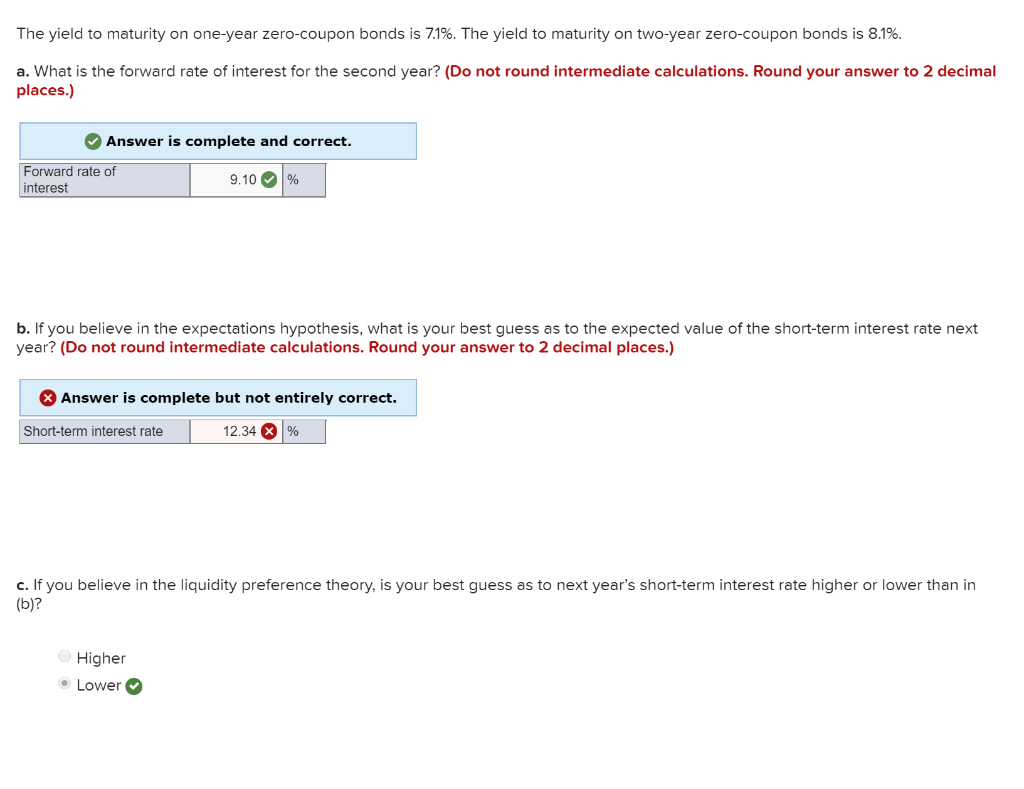

Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ... Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

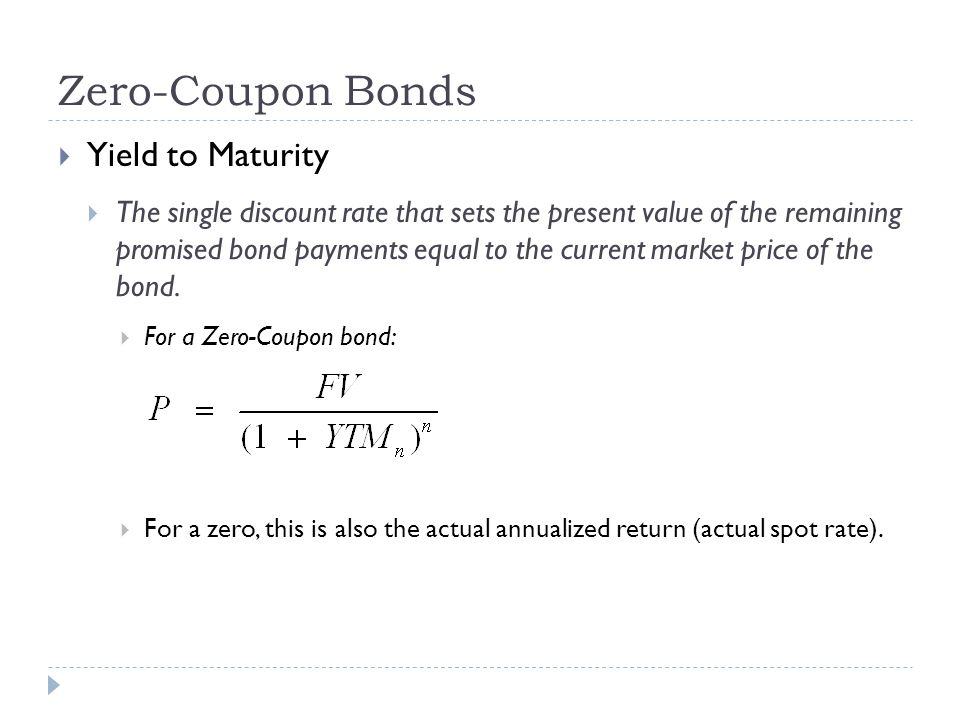

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

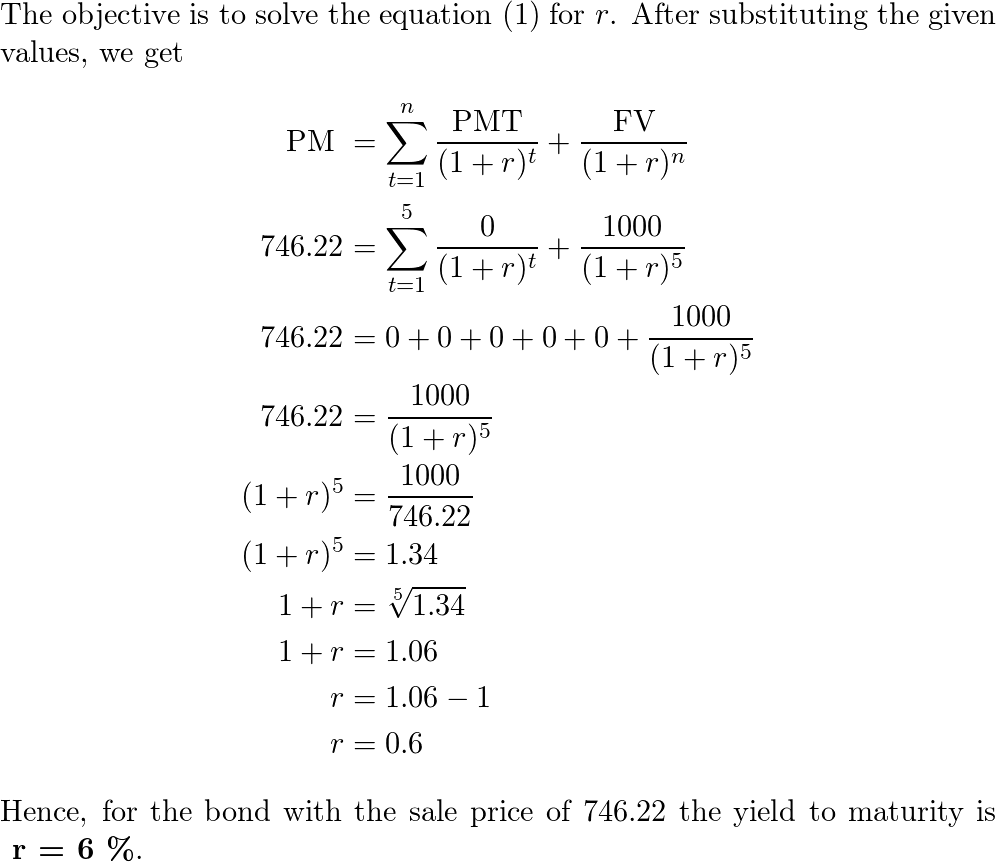

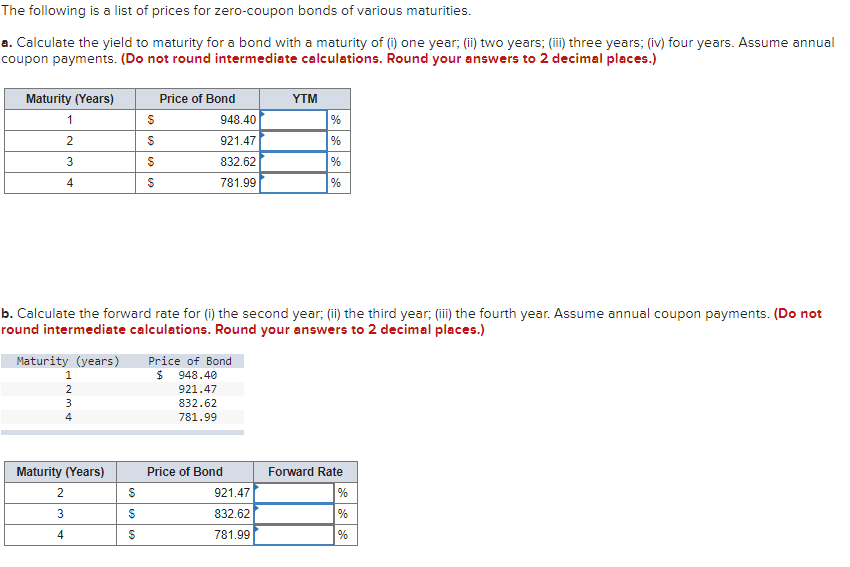

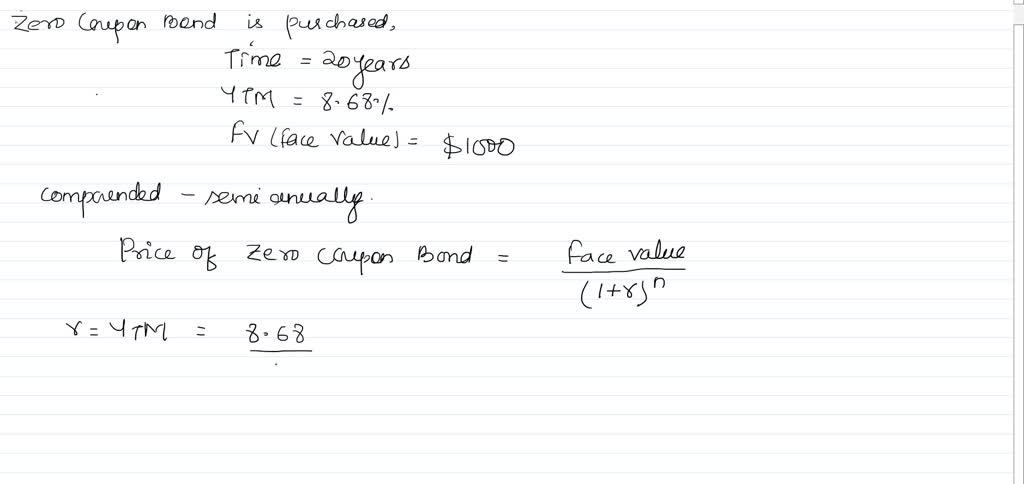

Yield to maturity for zero coupon bond

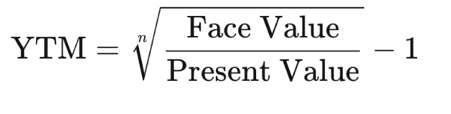

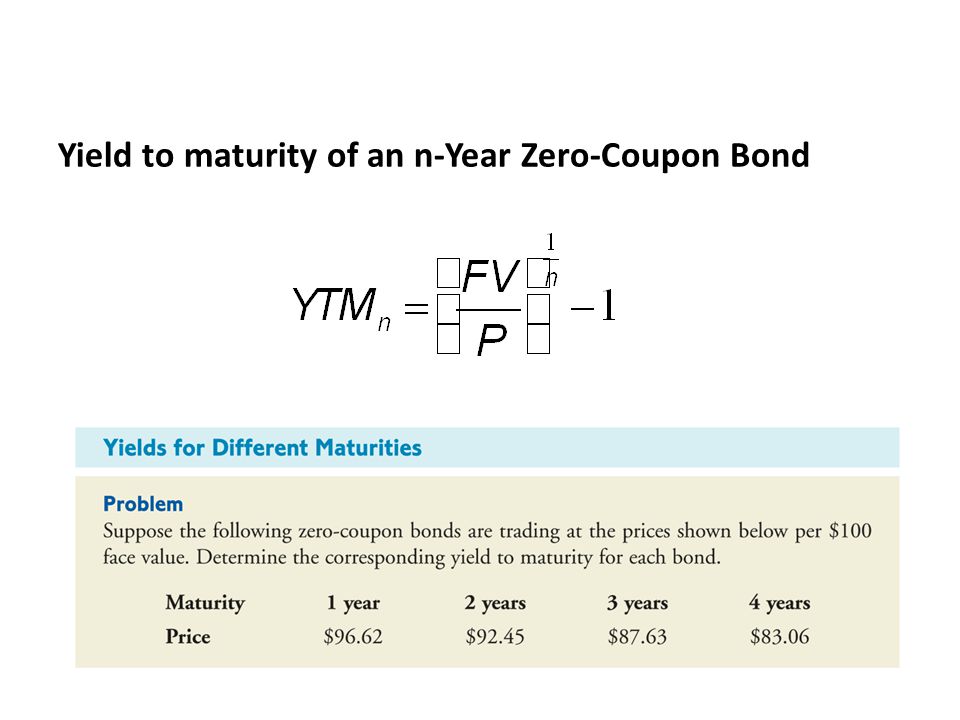

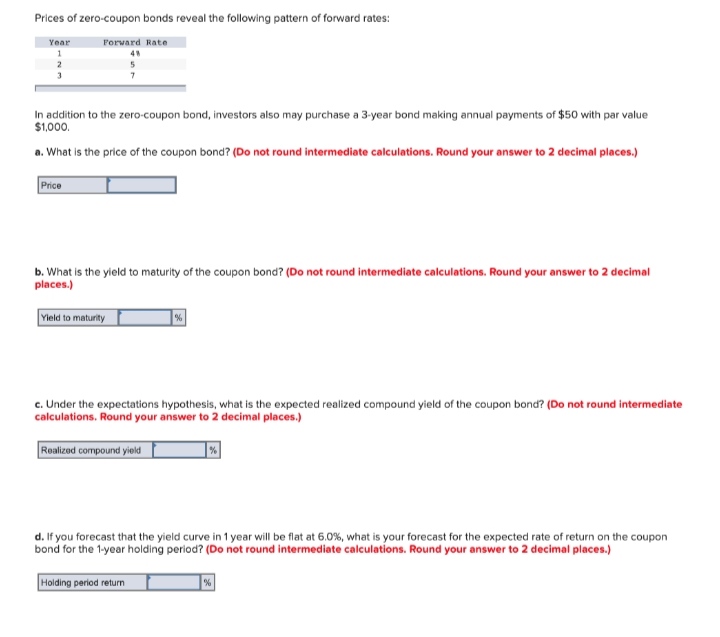

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: How to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ... Bond Yield to Maturity Calculator for Comparing Bonds Let's say you buy a 10 year $1000 bond with a 5% coupon. You hold that bond for the next few years collecting your $50 of annual interest. During that time, interest rates fall, and a comparable 10 year $1000 bond now carries a 4% coupon. Your original bond is now a much more valuable commodity, and it can be sold at a premium on the open market.

Yield to maturity for zero coupon bond. Yield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds Bond Yield to Maturity Calculator for Comparing Bonds Let's say you buy a 10 year $1000 bond with a 5% coupon. You hold that bond for the next few years collecting your $50 of annual interest. During that time, interest rates fall, and a comparable 10 year $1000 bond now carries a 4% coupon. Your original bond is now a much more valuable commodity, and it can be sold at a premium on the open market. How to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ... Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

:max_bytes(150000):strip_icc()/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "42 yield to maturity for zero coupon bond"