40 relationship between coupon rate and ytm

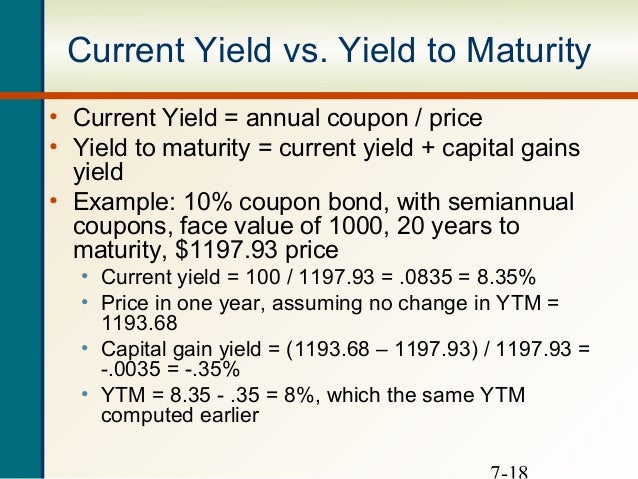

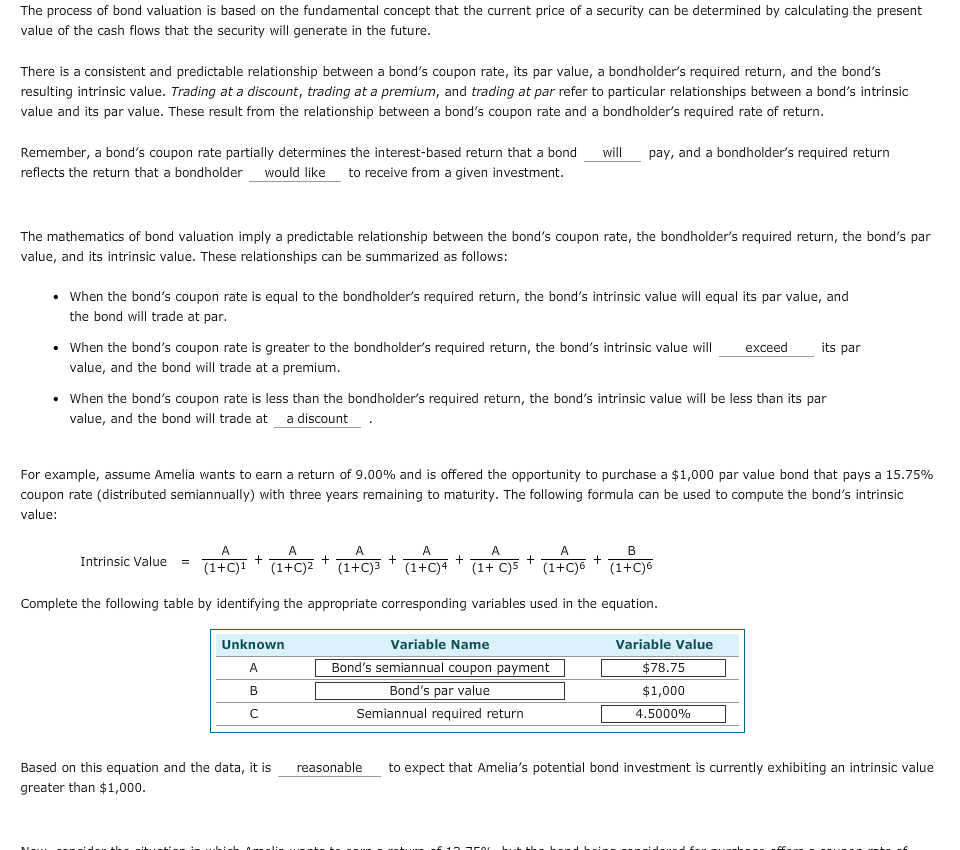

Returns, Spreads, and Yields | AnalystPrep - FRM Part 1 Study Notes If the coupon rate < YTM, the bond will sell for less than par value, or at a discount. If coupon rate= YTM, the bond will sell for par value. Over time, the price of premium bonds will gradually fall until they trade at par value at maturity. Similarly, the price of discount bonds will gradually rise to par value as maturity gets closer. Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Coupon Rate - Meaning, Calculation and Importance The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond. Let's assume the couponrate for a bond is 15%.

Relationship between coupon rate and ytm

Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A... Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate. Coupon Rate and Yield to Maturity - YouTube The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ...

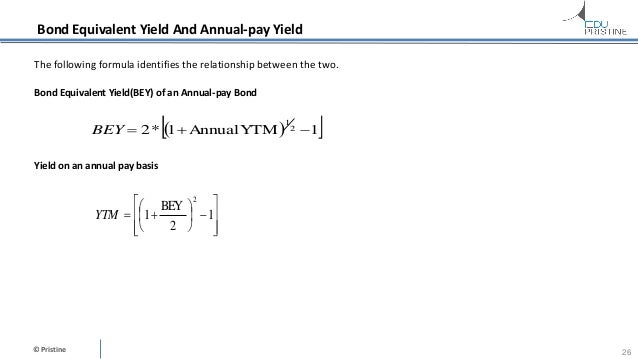

Relationship between coupon rate and ytm. What is the difference between the YTM and the coupon rate? The coupon rate is the interest rate on the bond at the time of issue. The YTM or Yield to Maturity is the yield based on the current price of the bond. For example, if a $1000 bond maturing in 10 years is issued at 5%, then 5% is the coupon rate, which means it will always pay $50 per year until maturity. Coupon vs Yield | Top 5 Differences (with Infographics) The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond. Yield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) - i.e. the discount rate which makes the present value (PV) of all the bond's future cash flows equal to its current market price. Yield to Maturity (YTM) Formula What is the relation between the coupon rate on a bond and its duration ... Click to see full answer. Moreover, what is the relationship between the price of a bond and its YTM? A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon payments) to equal the current bond price.YTM assumes that all coupon payments are reinvested at a yield equal to the YTM and that the ...

The Relationship Between a Bond's Price & Yield to Maturity The Relationship Between a Bond's Price & Yield to Maturity When you buy a bond, an important part of your return is the interest rate that the bond pays. However, yield to maturity is a more accurate representation of the total return you'll get on your investment. What relationship between a bond's coupon rate and a bond's yield would ... Answer (1 of 5): Thanks for the A2A. All the bonds have coupon interest rate, sometimes also referred to as coupon rate or simply coupon, that is the fixed annual interest paid by the issuer to the bondholder. Coupon interest rates are determined as a percentage of the bond's face value but diff... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Current Yield vs. Yield to Maturity - Investopedia When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate. Conversely, when a bond sells for less than par, which is known...

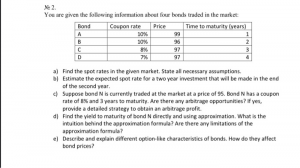

Answered: a) What is the relationship between the… | bartleby a) What is the relationship between the price of a bond and its YTM? b) Explain why some bonds sell at a premium over par value while other bonds sell at a discount. What do you know about the relationship between the coupon rate and the YTM for premium Relationship Between Coupon and Yield - Assignment Worker Coupon rate = 14%, semiannual coupons YTM = 16% Maturity = 7 years Par value = $1,000 Slide 14 6-14 Example 7.1 • Semiannual coupon = $70 • Semiannual yield = 8% • Periods to maturity = 14 • Bond value = • 70 [1 - 1/ (1.08)14] / .08 + 1000 / (1.08)14 = 917.56 ( ) ( )2t 2t 2 YTM1 F 2 YTM 2 YTM1 1 -1 2 C Value Bond + + + = The Relation of Interest Rate & Yield to Maturity - Pocketsense Most brokerage firms offer YTM estimates on potential purchases, and there are number of online calculators you can use to make estimates based on coupon rate and maturity date. In the example, if you paid a premium for the same six-year bond, say $101, your estimated YTM would decrease to about 4.8 percent, or about $28.80. Finance Exam 2 Flashcards | Quizlet Imagine Y1: -$1, Y2: +$2, which yields 100% return. Imagine Y2: -$10, Y2: +$12, which yields 20% return. IRR would have us decide that opportunity 1 is better, even though it's not by scale. For example, a higher IRR favors projects with higher upfront payments versus projects with lower upfront payments.

Solved Yield to maturity The bond shown in the following | Chegg.com Yield to maturity The bond shown in the following table pays interest annually. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Par value $1,000 Coupon interest rate 9% Years to maturity 8 Current value 0820 a. Calculate the yield to maturity (YTM) for the bond. b. What

Coupon vs Yield | Top 8 Useful Differences (with Infographics) 7. The Coupons are fixed; no matter what price the bond trades for. Yield and prices are inversely related. 8. An investor purchases a bond at its par value; the yield to maturity is equal to the coupon rate. An investor purchases the bond at a discount; its yield to maturity is always higher than its coupon rate.

Important Differences Between Coupon and Yield to Maturity Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

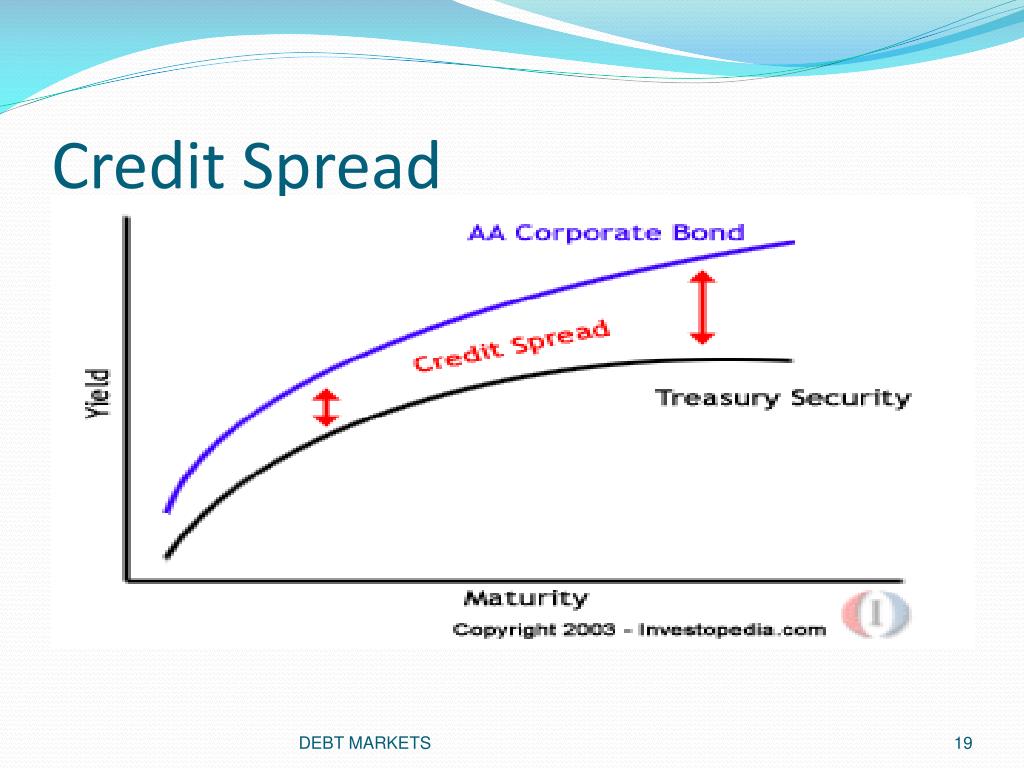

Basis Point Value - Overview, Bond Yields and Prices Basis point value of a bond is a measure of the price volatility of bond prices to 0.01% or 1 basis point change in its yield. Bond yields and their prices share an inverse relationship. Factors such as yield to maturity, coupon rate, and face value impact the relationship between the yield and price of the bond.

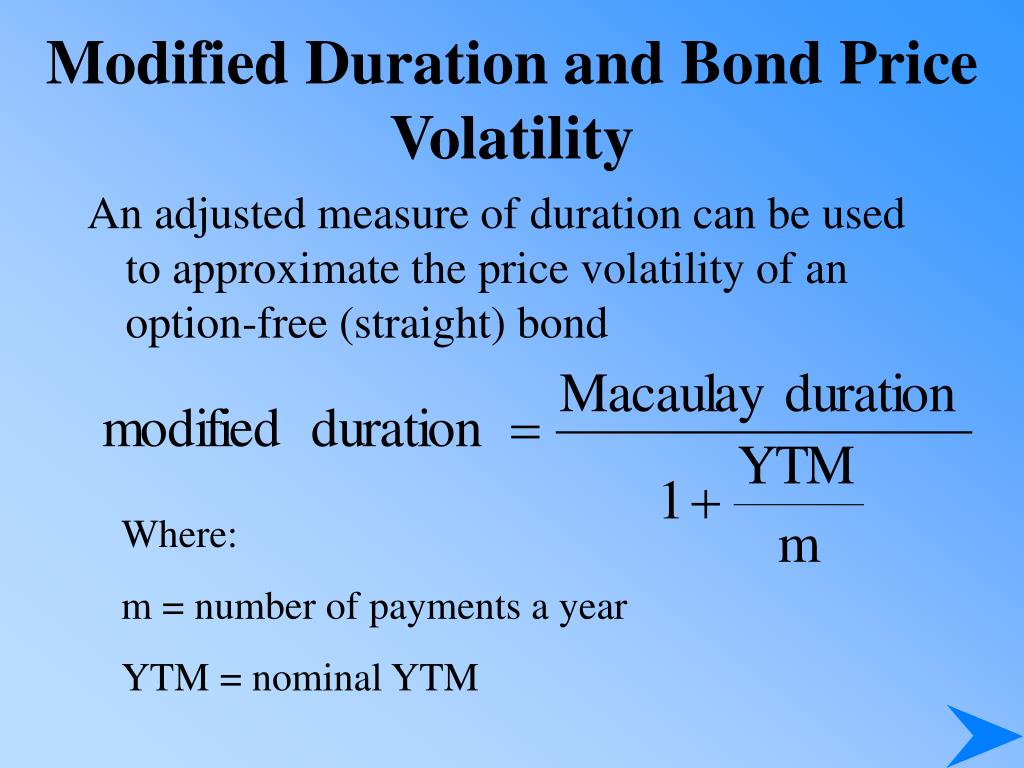

Bond Yield | Nominal Yield vs Current Yield vs YTM Where P 0 is the current bond price, c is the annual coupon rate, m is the number of coupon payments per year, YTM is the yield to maturity, n is the number of years the bond has till maturity and F is the face value of the bond.. The above equation must be solved through hit-and-trial method, i.e. you plug-in different numbers till you get the right hand side of the equation equal to the left ...

The Relation of Interest Rate & Yield to Maturity - Zacks When a coupon-paying bond is first issued by a corporation, the coupon rate is often set very close to the return required by investors for a security possessing risk characteristics of the bond...

Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : Help us improve.

Chapter 10 concept questions Flashcards & Practice Test - Quizlet For bonds selling at par value? a. Bond price is the present value term when valuing the cash flows from a bond; YTM is the interest rate used in valuing the cash flows from a bond. They have an inverse relationship. b. If the coupon rate is higher than the required return on a bond, the bond will sell at a premium, since it provides periodic ...

Solved (1) What is the relationship between the coupon rate | Chegg.com Do not just state the relationship, but please explain the rational behind the relationship as if you are explaining this relationship to a novice of Finance. \ (2) Both Bond X and Bond Y have 5% coupons, make semiannual payments, and have YTM of 4%. Bond X has five years to maturity, whereas Bond Y has 20 years to maturity.

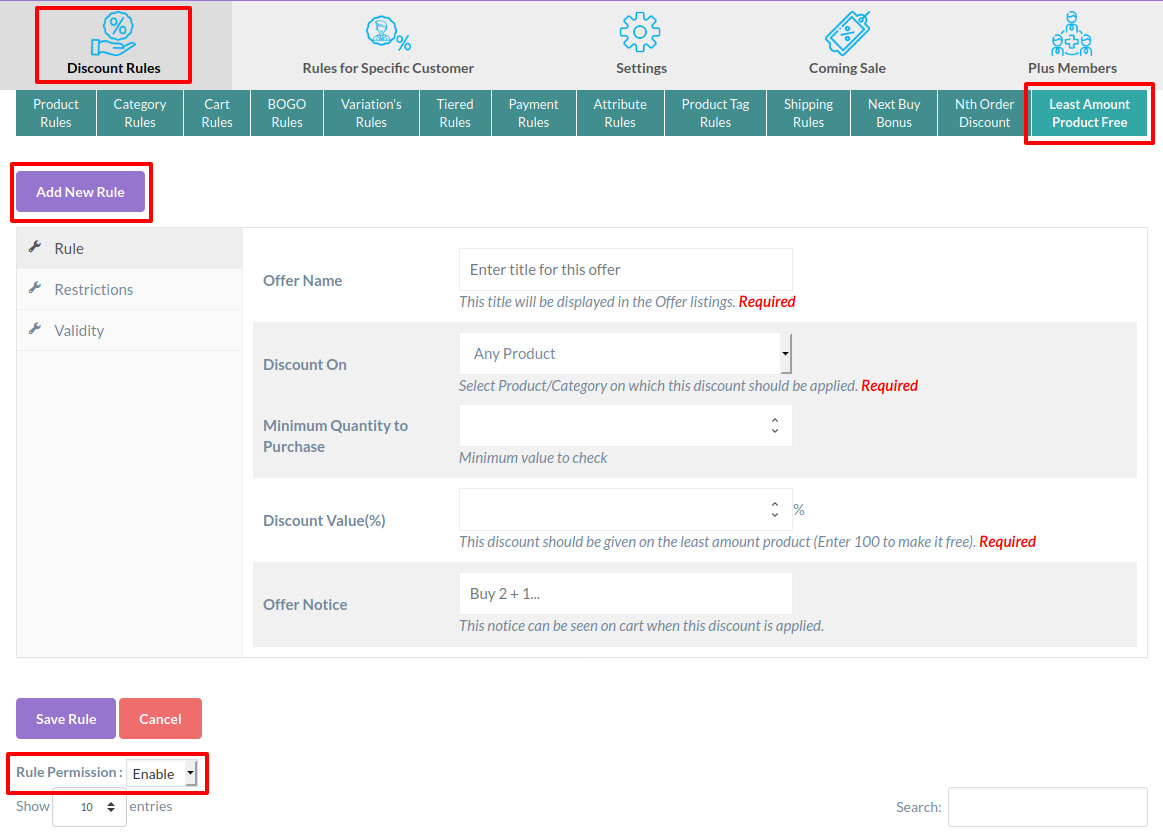

If I want to create a group price discount, how do I set the minimum number of tickets that must ...

Coupon Rate and Yield to Maturity - YouTube The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ...

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate.

Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A...

:max_bytes(150000):strip_icc()/BareYTMFormula-5d34698cfb7141d994781ca0fd54e332.jpg)

Post a Comment for "40 relationship between coupon rate and ytm"