41 zero coupon bonds definition

United States Treasury security - Wikipedia Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity.. Regular T-bills are commonly issued with maturity dates of 4, 8, 13, 26 and 52 weeks, each of these approximating a different number of … Zero Coupon Bonds financial definition of Zero Coupon Bonds Zero-coupon bonds, especially issues with long maturities, tend to have very volatile prices. Buy a zero-coupon bond with a 25-year maturity and watch the price plummet if market interest rates increase. Of course, the opposite also holds true. A long-term zero-coupon bond will produce substantial gains in value when market rates of interest ...

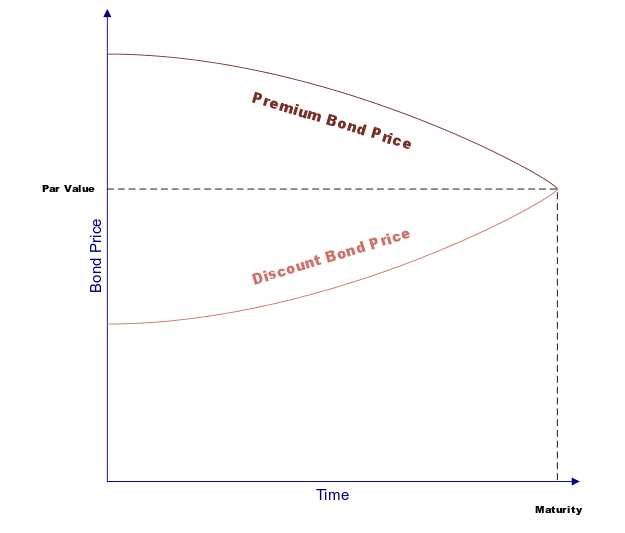

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond.

Zero coupon bonds definition

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ...

Zero coupon bonds definition. Zero Coupon Bond | Definition, Formula & Examples - Study.com A zero-coupon bond, which is also referred to as "an accrual bond", is a debt security that does not provide investors with periodic payments or periodic interests. Instead, this type of financial... Zero-Coupon Bonds Definition | Law Insider Define Zero-Coupon Bonds. means the senior unsecured convertible zero-coupon bonds due 2021 issued by the Borrower on May 7, 2001. zero coupon bonds definition and meaning | AccountingCoach zero coupon bonds definition. A bond without a stated interest rate. Because no interest is paid, the bond will sell for a discount from its maturity value. Rather than receiving interest, an investor's compensation will be the difference between the discounted price at which the bond was purchased and the price the investor receives when ... Zero-coupon bond financial definition of Zero-coupon bond A bond that provides no periodic interest payments to its owner. A zero-coupon bond is issued at a fraction of its par value (perhaps at $3 to $5 for each $100 of face value for a long-term bond) and increases gradually in value as it approaches maturity. Thus, an investor's income from a zero-coupon bond comes solely from appreciation in value.

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Oct 10, 2022 · Zero-coupon bonds often mature in ten years or more, ... Definition, Formula, and Example. Bond valuation is a technique for determining the theoretical fair value of a particular bond. Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include … What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying bonds,... › ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-coupon bonds often mature in ten years or more, ... Definition, Formula, and Example. Bond valuation is a technique for determining the theoretical fair value of a particular bond.

Zero Coupon Bonds Explained (With Examples) - Fervent The only thing they do pay is the Par (aka "face value") when the bond matures. Put differently, a zero coupon bond is a bond that doesn't pay any interest. Instead, it only pays a lump-sum payment at the end of the bond's life. That is, at its maturity or expiration date; i.e., the date when the bond matures or expires. › articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ... Arbitrage - Wikipedia The discount rates used should be the rates of multiple zero-coupon bonds with maturity dates the same as each cash flow and similar risk as the instrument being valued. By using multiple discount rates, the arbitrage-free price is the sum of the discounted cash flows. Arbitrage-free price refers to the price at which no price arbitrage is ... en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury bills, US ...

HM Treasury - GOV.UK - United Kingdom HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ...

Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today …

en.wikipedia.org › wiki › United_States_TreasuryUnited States Treasury security - Wikipedia The practice derives from the days before computerization, when treasury securities were issued as paper bearer bonds; traders would literally separate the interest coupons from paper securities for separate resale, while the principal would be resold as a zero-coupon bond.

Zero-coupon bond - definition of zero-coupon bond by The Free Dictionary Noun. 1. zero-coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the commonest form of zero-coupon security. zero coupon bond. governing, government activity, government, governance, administration - the act of governing; exercising authority; "regulations for the ...

Zero-Coupon Bond: Definition, How It Works, and How To … May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

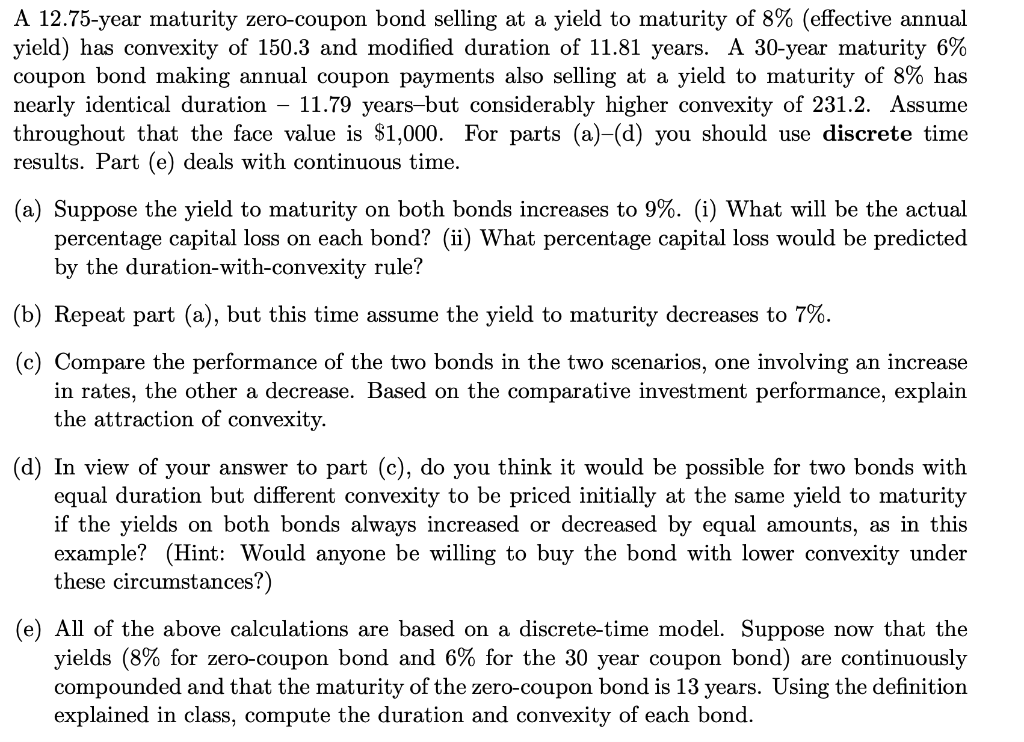

Duration and Convexity to Measure Bond Risk - Investopedia Jun 22, 2022 · However, for zero-coupon bonds, duration equals time to maturity, regardless of the yield to maturity. The duration of level perpetuity is (1 + y) / y. For example, at a 10% yield, the duration of ...

Zero-coupon bonds financial definition of Zero-coupon bonds Zero-coupon bonds, especially issues with long maturities, tend to have very volatile prices. Buy a zero-coupon bond with a 25-year maturity and watch the price plummet if market interest rates increase. Of course, the opposite also holds true. A long-term zero-coupon bond will produce substantial gains in value when market rates of interest ...

› terms › zZero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Zero-Coupon Bonds and Taxes - Investopedia A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. Zero-coupon bonds are more volatile than coupon bonds, so...

Zero coupon bond - definition of zero coupon bond by The Free Dictionary Related WordsSynonymsLegend: Switch to new thesaurus Noun 1. zero coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the commonest form of zero-coupon security zero-coupon bond governing, government activity, government, governance, administration - the act of governing; exercising authority; "regulations for the ...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs...

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor. Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself.

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

› articles › bondsUnderstanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond.

Zero Coupon Bonds - definition of Zero Coupon Bonds by The Free Dictionary Zero Coupon Bonds synonyms, Zero Coupon Bonds pronunciation, Zero Coupon Bonds translation, English dictionary definition of Zero Coupon Bonds. Noun 1. zero-coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ...

corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

Post a Comment for "41 zero coupon bonds definition"